Scottish Budget 2026-27: Income Tax Changes & Mansion Tax Guide

As we track shifting fiscal policies across the UK, Scotland’s 2026–27 Budget represents the most significant divergence in tax policy since devolution. Our analysis breaks down how these changes impact cross-border professionals and Scottish households alike, providing the essential clarity needed to navigate a tax landscape that is now uniquely decoupled from the rest of the UK.

In a nutshell, here’s what’s changed:

- Starter and basic thresholds are up 7.4% for lower and middle earners

- The 48% top tax rate stays, with higher earners paying more

- Under £33,500 earners pay less than most of the UK

- Higher earners face bigger bills, with new property taxes from 2028

Let me walk you through the numbers, the logic behind them, and what they really mean for your money in 2026–27.

Quick Summary: How do these changes affect you?

The 2026–27 Scottish Budget introduces specific shifts based on your income level. Click a link below to jump to your section:

- ✅ Earn under £33,500? You will pay up to £40 less tax than elsewhere in the UK.

- ⚠️ Earn over £43,663? You are impacted by frozen higher-rate thresholds and the “Scottish Tax Gap.”

- 🏠 Property owner? New “Mansion Tax” bands I and J apply to homes over £1M from April 2028.

- 💼 Business owner? New 15% relief for retail, hospitality, and leisure sectors.

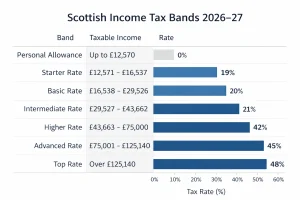

What Are the New Scottish Income Tax Rates for 2026–27?

The Scottish Government has confirmed the following income tax bands and rates for the 2026–27 tax year.

| Band | Taxable Income Range | Tax Rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Starter Rate | £12,571 – £16,537 | 19% |

| Basic Rate | £16,538 – £29,526 | 20% |

| Intermediate Rate | £29,527 – £43,662 | 21% |

| Higher Rate | £43,663 – £75,000 | 42% |

| Advanced Rate | £75,001 – £125,140 | 45% |

| Top Rate | Over £125,140 | 48% |

*Note: The Personal Allowance is reduced by £1 for every £2 earned over £100,000 and disappears entirely above £125,140.

Breakdown of 2026–27 Tax Bands

It’s important to note that the personal allowance disappears completely once you earn above £125,140.

What’s Actually Changed?

- The starter, basic, and intermediate thresholds have all increased by 7.4%, meaning low and middle earners will pay the lower rates on more of their income.

- The higher, advanced, and top rate bands remain frozen, meaning more people could move into those brackets over time due to wage inflation.

As Finance Secretary Shona Robison put it:

“To deliver even more for those with the least, we will ask those with the most, the very wealthiest in our land, to contribute that little bit more.”

From where I stand, this seems like a step towards greater tax fairness, but it also creates some grey areas, especially around fiscal drag.

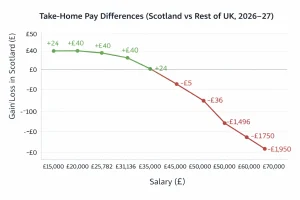

How Do These Tax Changes Affect Take-Home Pay?

Changes in tax policy often feel abstract until you see their direct impact on your pay packet. Thankfully, we now have concrete salary comparisons that show exactly how much more or less you’ll take home.

Take-Home Pay Differences (Scotland vs Rest of UK, 2026–27)

Salary Gain/Loss in Scotland

£15,000 +£24

£20,000 +£40

£25,782 +£40

£31,136 +£24

£35,000 –£15

£40,000 –£65

£45,000 –£396

£50,000 –£1,496

£60,000 –£1,750

£70,000 –£1,950

What This Means in Reality?

If you earn under £33,500, you’re likely to pay slightly less tax than your counterparts in England. However, if you’re earning above £43,662, that’s where the pain begins.

Take my friend Claire, for example, a school leader earning £60,000. She’s looking at a tax bill that’s around £1,750 higher than her sister in Birmingham. While she understands the principle of progressivity, she told me, “It feels like a penalty for working hard and getting promoted.”

On the flip side, my younger cousin, a recent graduate earning £25,000, will actually save around £40 annually. Not a game-changer, but every bit helps in this economy.

Scotland vs. England: The 2026–27 “Tax Gap” Comparison

While personal stories help us understand the impact, the data tells the real story. Below is the direct comparison of income tax liabilities between a Scottish resident and someone living in the rest of the UK (rUK) for the 2026–27 tax year.

| Gross Annual Salary | Tax Paid (Rest of UK) | Tax Paid (Scotland) | The “Tax Gap” (Difference) |

|---|---|---|---|

| £25,000 | £2,486 | £2,446 | -£40 (Saving) |

| £33,500 | £4,186 | £4,186 | £0 (Break-even) |

| £50,000 | £7,486 | £8,982 | +£1,496 (Gap) |

| £75,000 | £17,432 | £19,551 | +£2,119 (Gap) |

| £100,000 | £27,432 | £30,732 | +£3,300 (Gap) |

| £150,000 | £53,500 | £59,631 | +£6,131 (Gap) |

Figures are based on the 2026–27 Budget confirmed on 13 January 2026. Data assumes a standard Personal Allowance of £12,570.

How Much More (or Less) Will You Pay Compared to the Rest of the UK?

In the 2026–27 tax year, those earning under approximately £33,500 will pay slightly less income tax than their counterparts in England, Wales, or Northern Ireland. However, the gap for higher earners continues to widen due to the higher Scottish rates.

| Gross Annual Salary | Tax Paid (Rest of UK) | Tax Paid (Scotland) | Annual Difference |

|---|---|---|---|

| £20,000 | £1,486 | £1,446 | -£40 (Less) |

| £30,000 | £3,486 | £3,451 | -£35 (Less) |

| £40,000 | £5,486 | £5,551 | +£65 (More) |

| £50,000 | £7,486 | £8,982 | +£1,496 (More) |

| £75,000 | £17,432 | £19,551 | +£2,119 (More) |

| £100,000 | £27,432 | £30,732 | +£3,300 (More) |

| £150,000 | £53,500 | £59,631 | +£6,131 (More) |

*Note: Calculations include the 2026-27 Scottish thresholds (7.4% uplift for Basic and Intermediate bands) compared to frozen UK thresholds. Figures are rounded to the nearest pound and exclude National Insurance.

Why Is Scotland’s Income Tax System More Progressive Than the Rest of the UK?

The current income tax system in Scotland reflects a deliberate effort to apply progressive taxation, where those with higher earnings contribute proportionally more. Since tax powers were devolved, Holyrood has diverged from Westminster with a goal of reducing inequality.

Key Features of Scottish Progressivity:

- Scotland uses six tax bands, compared to three in the rest of the UK.

- It introduces small, incremental increases between bands to smooth the jump from one rate to another.

- It retains lower rates at the bottom to shield the lowest earners.

This structure ensures that someone on £20,000 isn’t disproportionately burdened, while someone earning six figures contributes more toward public services.

As economist João Sousa stated:

“The system is more equitable in theory, but its success depends on how well it’s supported by infrastructure and spending.”

From my experience, the intent is sound, but the challenge lies in its complexity and the pressure it places on middle earners.

Why Are 55% of Scots Expected to Pay Less Income Tax?

The Scottish Government says around 55% of taxpayers will be better off than if they lived elsewhere in the UK, based on updated earnings forecasts and changes to income tax thresholds for 2026–27.

This figure comes from extending the lower and middle income bands, allowing more people to pay less tax on a larger portion of their earnings compared with the rest of the UK.

Most of the savings are relatively small but widespread. Income between £12,571 and £29,526 benefits from the adjusted starter and basic rates, which slightly reduces the tax burden for many workers.

However, critics argue that these gains could be eroded by inflation and by frozen upper thresholds, which may push more people into higher tax bands over time.

What Is the Fiscal Drag Effect and How Will It Impact Scottish Taxpayers?

Fiscal drag is the silent killer of take-home pay. It happens when wages increase due to inflation or raises, but tax thresholds remain the same, pulling more people into higher bands.

This year’s budget freezes the higher, advanced, and top thresholds, which means many Scots will effectively pay more tax without actually earning more in real terms.

As Neil Winstanley, Chartered Financial Planner at Quilter Cheviot, puts it:

“Ordinary professionals — teachers, nurses, police officers — are now being dragged into 42% tax bands. This is the quiet erosion of real income.”

While I haven’t reached the higher band yet, I’m just a few thousand away. And with no upward adjustment for inflation, it’s only a matter of time before more of us fall into that bracket, without really feeling richer.

What Other Tax Reforms Were Announced in the 2026–27 Scottish Budget?

The Budget was about more than just income tax. Several wealth-focused and property-related measures were introduced or announced for the coming years.

Other Major Tax Measures Announced:

- Mansion Tax: New Council Tax Bands I and J for properties over £1m, starting in 2028

- Air Departure Tax: A private jet levy will be introduced, exempting the Highlands and Islands

- Business Rates Relief: 15% relief over three years for eligible retail, hospitality, and leisure sectors

- No increase in Stamp Duty equivalent (Land and Buildings Transaction Tax) for now

These measures are aimed at increasing revenue from wealthier property owners and supporting struggling industries, though some argue they’re more political than practical.

What Support Measures Accompany These Tax Changes?

It’s not all about taking more. The Budget also outlines expanded social and family support, aimed especially at lower-income households and children.

Key Social Benefits:

- Scottish Child Payment: Will rise to £40/week from 2027 for families with children under one

- Free Breakfast Clubs: Available at every primary and special school by August 2027

- “Summer of Sport”: Free access to swimming and activities for all primary-aged children

The Mechanics of the 2026–27 Budget

“While income tax policy is debated in Holyrood, the Scottish Government’s spending power is still heavily tied to the Block Grant, the core funding provided by Westminster via the Barnett Formula.

According to the latest forecasts from the SFC (Scottish Fiscal Commission), the decision to uplift the Basic and Intermediate thresholds by 7.4% means that approximately 55% of Scottish taxpayers will pay less income tax than they would in the rest of the UK. However, the SFC also notes that this relief is largely offset by ‘fiscal drag’ for middle and higher earners, as their thresholds remain frozen.

It is also important for taxpayers to remember that National Insurance contributions remain a reserved matter. Regardless of the diverging income tax rates set by the Scottish Parliament, your National Insurance rates stay identical to those in England and Wales, as these are still controlled by the UK Treasury.”

What Do Experts and Politicians Say About the Scottish Budget Income Tax Changes?

Reactions to the Scottish Budget’s income tax changes have been sharply divided across politics and policy experts. The SNP has defended the plans as progressive and sensitive to the cost-of-living crisis, arguing that lower and middle earners are being protected.

In contrast, the Scottish Conservatives have criticised the package as being “high on tax, low on delivery,” while Scottish Labour warned it amounts to little more than “tinkering” without meaningful structural reform.

Think tanks such as the IPPR and the Institute for Fiscal Studies have also raised concerns about sustainability and transparency.

David Phillips of the IFS made this pointed remark:

“That isn’t good enough – especially in an election year, when the electorate deserve a clear picture of how tax and spending are changing.”

It underlines how these tax changes sit within a much wider debate about trust, public services, and fiscal responsibility.

What Happens Next – Will the Budget Become Law?

A final vote on the Scottish Budget Bill is scheduled for 25 February 2026. With the SNP in minority, passing it will depend on securing support from other MSPs, most likely the Greens or Liberal Democrats.

Once passed, income tax changes will take effect in April 2026, with other policies (like council tax reforms) scheduled for 2028.

If a new administration is elected in the May Holyrood elections, it may introduce an emergency budget, but any structural tax changes would still need to wait until the following financial year.

Final Thoughts – Are These Tax Changes a Good Deal for Scottish Taxpayers Like Me?

After going through the numbers and analysing the big picture, I’m left feeling cautiously optimistic, but not without reservations. I’m one of those in the middle: not earning enough to feel the benefit of higher thresholds, yet close enough to the next band to feel fiscal drag creeping in.

But I also see the logic behind progressive taxation and targeted social support. If it helps families, supports education, and funds better healthcare, maybe paying a little more is worth it, assuming it’s well spent. As always, the devil is in the delivery.

FAQs About the Scottish Budget and Income Tax Changes

What is the personal allowance for Scotland in 2026-27?

It remains at £12,570, but disappears entirely once income exceeds £125,140.

Do these tax changes apply UK-wide?

No, these rates apply only to Scottish taxpayers. Other UK regions follow Westminster tax policy.

How much more tax do higher earners in Scotland pay?

At £50,000, Scots will pay roughly £1,496 more annually than those elsewhere in the UK.

What is fiscal drag in simple terms?

It’s when wage increases push you into higher tax bands, even though your purchasing power hasn’t actually improved.

When does the mansion tax come into effect?

From April 2028, homes valued over £1 million will face new council tax bands I and J.

Are there changes to business taxes?

Yes. A 15% relief on non-domestic rates applies to eligible sectors from 2026–27.

Will these tax rates change again before the next election?

Unlikely. The Scottish Government has promised to keep rates stable until the end of this parliamentary term.