Odds of Winning Premium Bonds With £50,000 in 2026 – What Are Your Real Chances?

If you have £50,000 in Premium Bonds, you might be wondering what your real chances of winning actually are. With more savers choosing this tax-free, prize-based savings option, it’s important to understand what you can realistically expect.

When you look at prize data, calculators, and official statistics, one thing becomes clear: while £50,000 gives you much better odds than smaller investments, winning still depends a lot on luck.

With £50,000 invested:

- You get 50,000 entries in every monthly draw (one for each £1).

- The average annual return at current prize rates is around £1,800.

- However, the median return is £0, which means many people still win nothing.

So while the potential rewards look appealing, Premium Bonds do not offer guaranteed returns.

What Are Premium Bonds and How Do They Work in 2026?

Premium Bonds are a unique savings product issued by the UK government through National Savings & Investments (NS&I). Instead of earning interest, bondholders are entered into a monthly prize draw where each £1 bond has an equal chance of winning a cash prize.

You can invest a minimum of £25 and up to a maximum of £50,000. Prizes range from £25 to £1 million, and all winnings are completely tax-free. Importantly, while your capital is secure, there’s no guaranteed return.

A random number generator, affectionately known as “Ernie”, draws the winners each month. Over six million prizes are distributed every draw, but that doesn’t mean you’ll win.

How Does the Premium Bonds Prize System Work?

Premium Bonds don’t function like regular interest-bearing savings products. Instead, every eligible bond participates in a prize draw every month.

Prize Fund Rate

As of early 2026, the prize fund rate is 3.6%, which determines the total prize pot distributed each month. It is important to note this is a mean average, some people win big, most win small or nothing at all.

Prize Categories and Volume

Every month, NS&I allocates millions of pounds in prizes. These are divided into several tiers:

- 2 x £1 million jackpot prizes

- Dozens of £100,000, £50,000, and £25,000 prizes

- Thousands of £1,000, £500, and £100 prizes

- Millions of £25 prizes

Draw Mechanism

All bonds are equally eligible in every draw. The draw itself is random, your odds don’t improve based on how long you’ve held your bonds or how many times you’ve won before.

What Are the Odds of Winning Premium Bonds With £50,000?

With the current odds sitting at 1 in 22,000 for a £1 bond to win any prize in a month, holding the maximum amount of £50,000 (50,000 bonds) puts you in a stronger position than someone with smaller holdings.

With that many bonds, you could reasonably expect:

- Around 2 to 4 wins per month, based on averages

- Mostly £25 prizes

- The occasional £50 or £100 prize if luck is on your side

However, it’s still possible to go a month, or even several, without a single win. This is where Premium Bonds differ from savings: you’re not promised anything. While your odds improve with more bonds, they don’t guarantee consistent returns.

How Much Can You Expect to Win With £50,000 in Premium Bonds?

There’s often confusion between the average (mean) and median returns when it comes to Premium Bonds.

- The average return based on the 3.6% prize rate is roughly £1,800 per year

- The median return, what most people actually receive, is often £0 to £300 annually

This discrepancy exists because a small number of investors win large sums, skewing the mean. For most people, especially those not reinvesting prizes or checking regularly, the actual financial benefit is more limited.

Real-Time Example (2025–2026)

Consider the experience of Helen, a 47-year-old civil servant from Surrey who invested her full £50,000 into Premium Bonds in February 2025. She tracked her monthly wins until January 2026:

- Total prizes won: £1,375

- Number of winning months: 10 out of 12

- Most common prize: £25

- Highest single prize: £100

While Helen enjoyed the security and simplicity of Premium Bonds, she noted the returns were lower than a 4.5% savings account would have delivered over the same period £2,250 in guaranteed interest. Still, she appreciated the tax-free nature of her winnings and the “thrill” of the monthly draw.

“It felt like a savings account with a lottery twist. I didn’t get rich, but it was fun and safe.” – Helen, Surrey

Expected vs Median Returns on £50,000

Return Type Annual Return Description

Mean (Average) ~£1,800 Based on 3.6% prize fund rate

Median (Typical) £0–£300 Reflects what most people actually take home

The conclusion? Even with £50,000, most holders can’t expect consistent, high returns, though small, steady wins are probable.

How Do the Odds Compare for £10,000, £20,000, or £30,000 in Premium Bonds?

To better understand where the £50,000 sweet spot fits, let’s compare returns and odds across smaller investment levels.

Estimated Annual Returns by Holding Size:

Investment Amount Median Annual Return Average Annual Return Monthly Win Probability

£10,000 £300 £360 Moderate

£20,000 £600–£650 £720 High

£30,000 £900–£1,100 £1,080 Very High

£50,000 £1,600–£1,800 £1,800 Extremely Likely

Investing more increases your number of entries, which does improve your statistical chances, but you’re still gambling against long odds for significant prizes.

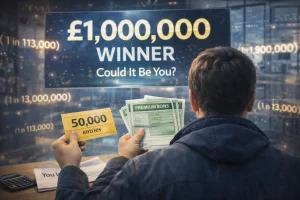

What Are the Odds of Winning £1 Million on Premium Bonds With £50,000?

With £50,000 invested, your annual chance of winning the £1 million jackpot is about 1 in 113,000. That may seem feasible compared to lottery odds, but bear in mind:

- There are only two £1 million prizes each month

- Over 22 million people hold Premium Bonds

- The odds reset every month; past losses don’t increase your chances

“Even with £50,000 invested, the odds of becoming a millionaire through Premium Bonds are extremely slim. It’s more of a fun side dream than a viable retirement plan.”

— Private Client Adviser, Birmingham

So while it’s better than one ticket in the lottery, it’s still statistically unlikely.

Premium Bonds vs Savings Accounts – Which Is Better for £50,000?

With interest rates around 4.5%, traditional savings accounts are making a comeback. When comparing Premium Bonds with these options, the key differences are guaranteed income vs tax-free prize-based returns.

Case Study: Mark’s £50,000 Dilemma

Mark, a 52-year-old higher-rate taxpayer from Manchester, faced a choice in March 2025:

Should he place his £50,000 savings into a high-interest savings account paying 4.5%, or Premium Bonds?

After researching, he split his investment:

- £25,000 in Premium Bonds

- £25,000 in a top easy-access savings account

Results after 12 months:

- Premium Bonds winnings: £850 (tax-free)

- Savings account interest: £1,125 (taxed at 40% = £675 net)

“When I saw the numbers, I realised Premium Bonds actually outperformed the savings account, for me as a higher-rate taxpayer. I still like knowing my money is secure, and I have a chance at something bigger.”

Mark’s case shows Premium Bonds can provide better net value for those paying tax on interest, especially at higher rates.

Premium Bonds vs High-Interest Savings

Account Type Annual Return Tax-Free Risk of Losing Capital Withdrawal Time

Premium Bonds £1,600–£1,800 Yes None ≤ 3 days

4.5% Savings A/C £2,250 (gross) No None (FSCS up to £85k) Varies

Fixed-Rate ISA £2,140 (4.28%) Yes None Limited

In Mark’s situation, Premium Bonds provided more post-tax value, plus flexibility. However, for basic-rate taxpayers or those under the Personal Savings Allowance, savings accounts still typically outperform.

Is Putting £50,000 in Premium Bonds Worth It in 2026?

Whether putting £50,000 into Premium Bonds in 2026 is worth it depends mainly on what you want your money to achieve and how comfortable you are with uncertainty.

Premium Bonds can be a sensible place for savings you want to keep safe, do not need immediate access to, and are willing to leave untouched while hoping for tax-free prizes. For some people, the chance of winning makes holding cash more enjoyable than earning fixed interest.

However, if your main priority is steady, predictable income, high-interest savings accounts will almost always provide better returns. Premium Bonds are not a traditional investment but a savings product with lottery-style features.

How to Calculate Your Odds and Returns Using Premium Bonds Tools?

Premium Bond calculators, available from NS&I and other finance platforms, help you assess your likely outcomes based on:

- Your total bond value

- Current prize fund rate

- Number of entries per month

- Tax considerations (if applicable)

These tools provide a helpful probability-based forecast, but results vary month to month and are never guaranteed. If you’re a numbers person, using the calculator before investing can set more realistic expectations.

How to Improve Your Chances of Winning with Premium Bonds?

Although Premium Bonds are based on random draws and cannot be manipulated, there are still a few smart ways you can maximise your chances over time. These strategies won’t guarantee wins, but they do help you get the most out of your money.

Invest the Full £50,000

By holding the maximum £50,000, you receive 50,000 entries in every monthly draw. This gives you far better odds than smaller holdings, as every £1 equals one chance to win. More bonds simply means more opportunities each month.

Reinvest Your Winnings

If you win, reinvesting your prizes back into Premium Bonds increases your total number of entries. Over time, this compounding effect can slowly improve your odds without adding extra money.

Hold for the Long Term

Premium Bonds reward patience. The longer you stay invested, the more monthly draws you enter, which increases your overall chance of winning across time.

What Do People Say Online? Reddit & Real-World Experiences

Online forums like Reddit and personal finance blogs are filled with stories ranging from huge wins to long dry spells. Common themes include:

- Some report monthly wins of £25 or £50 regularly

- Others have held £50k for years without a major prize

- Many value the low-risk, tax-free nature despite modest returns

The general consensus? It’s not a get-rich-quick option, but it’s also not a bad place to hold money you want to keep secure, with a touch of hope.

What Happens If You Don’t Win Anything With £50,000 in Premium Bonds?

If you don’t win anything with £50,000 in Premium Bonds, it can be frustrating, but it is completely possible. Even at this level, some people go months without a single prize.

During that time, your money is effectively earning nothing, which means you are missing out on guaranteed interest you could have earned elsewhere. For example, in a 4.5% easy-access savings account, £50,000 would generate about £187.50 per month without any risk.

This highlights the opportunity cost of holding Premium Bonds. If you care more about steady returns than the thrill of winning, Premium Bonds may not be the best option.

Conclusion

If you invest £50,000 in Premium Bonds in 2026, you’re almost certain to win some prizes, most likely a handful of £25 wins spread across the year. Statistically, your average return hovers around 3.6%, but you may not achieve that.

Premium Bonds can be a fun and safe place to hold savings, particularly if you’re a higher-rate taxpayer or enjoy the thrill of monthly draws. But if your aim is consistent, guaranteed returns, then a top-paying savings account or ISA is still the smarter bet.

Ultimately, Premium Bonds are less about smart investing and more about risk-free gambling with your savings, and for some, that’s worth the cost of missed interest.

Frequently Asked Questions

What’s the actual return for £50,000 in Premium Bonds?

The average return is about £1,800 annually, but many receive less or even nothing, due to the lottery-based system.

How do Premium Bonds compare with ISAs or savings accounts?

Savings accounts offer guaranteed returns and often outperform Premium Bonds, unless you’re in a higher tax bracket and value tax-free prizes.

Are Premium Bond winnings truly tax-free?

Yes. Regardless of your income, all Premium Bond prizes are tax-free and do not count toward your personal savings allowance.

How often can I expect to win?

With £50,000, you’re likely to win something most months, but the prize value may be minimal.

Can Premium Bonds beat inflation?

Rarely. With inflation at ~3.2% and the median return below the prize rate, most holders will lose value in real terms.

Is there a strategy to maximise Premium Bond winnings?

Only by holding the maximum and reinvesting winnings. There’s no way to influence the draw or improve odds beyond that.

Can I withdraw Premium Bonds easily?

Yes. You can cash in anytime, and funds are usually returned within 3 working days.