Is the State Pension Being Reduced? | Facts vs Myths Explained

No, the UK State Pension is not being reduced. Despite widespread claims circulating online, official government policy confirms that State Pension payments are continuing to rise, not fall.

In recent months, misleading headlines and viral social media posts have caused unnecessary concern among current and future pensioners, with some falsely claiming cuts of £100 or more per month. These claims have been officially debunked.

In reality, the UK State Pension continues to rise each year under the triple lock, which increases payments by the highest of inflation, earnings growth, or 2.5%. For 2025/26, the full new State Pension is £230.25 per week, with a rise to around £241.30 expected in 2026/27.

Key points to understand from the outset include:

- The State Pension amount is rising, not falling

- The triple lock remains in place

- Changes mainly affect State Pension age, not weekly payment amounts

- Viral claims about pension cuts are misleading and incorrect

This article separates fact from fiction, explains what is genuinely changing, and provides clear, evidence-based information on how the UK State Pension works today.

What Is the State Pension and How Does It Work in the UK?

The State Pension is a regular payment from the UK government for those who’ve reached the qualifying retirement age and have made sufficient National Insurance (NI) contributions.

It’s not a fixed figure for everyone, it varies based on when you retire, how many NI years you’ve built up, and whether you fall under the new or basic state pension scheme.

New vs Basic State Pension

- The new State Pension applies to men born on or after 6 April 1951 and women born on or after 6 April 1953. To receive the full rate, individuals typically need 35 qualifying years of NI contributions.

- The basic State Pension applies to those who reached pension age before April 2016 and usually requires 30 qualifying years for the full amount.

The full new State Pension in 2025/26 is £230.25 per week, and this is expected to rise by approximately 4.8% in 2026/27, reaching £241.30.

Your actual entitlement might be higher or lower based on your individual NI history, especially if you were previously contracted out of the additional State Pension.

Why Are People Asking If the State Pension Is Being Cut?

The increase in public concern stems from widespread online misinformation, particularly viral posts claiming cuts of over £100 per month. These claims, although emotionally impactful, are unfounded and misleading.

“I read online that my pension would drop by £100 a month, I panicked until I checked the official figures,” shared one Facebook user, reflecting a sentiment felt by many.

Such rumours often originate from unverified blogs, AI-generated articles, or misinterpretations of legitimate policy changes, such as the gradual rise in state pension age, which is frequently mistaken for a reduction in pension value.

Social media platforms and forums amplify these fears, as users share and discuss snippets of information, often taken out of context. In reality, there are no government plans to reduce the state pension amount. Instead, changes are focused on sustainability, age eligibility, and ensuring fair inflation-based increases.

Is There Any Truth to Claims About State Pension Reductions?

To put it plainly, no, there is no confirmed reduction to the state pension. The confusion arises largely because of how changes in pension age and variable entitlements are interpreted. For example, if someone has fewer than 35 qualifying years or was contracted out, they may receive less than the full amount, but this is not a reduction to the standard rate.

“There is no across-the-board cut. The triple lock remains in place,” clarified a DWP representative during a recent parliamentary session.

Those feeling short-changed might simply be receiving their individually calculated entitlement, not experiencing an actual “cut”. Furthermore, those who’ve reached pension age with gaps in NI records or incomplete years might see a lower pension due to personal contribution history, not policy changes.

What Is the Triple Lock and How Does It Protect the State Pension?

Introduced in 2010, the triple lock is a commitment that guarantees annual increases in the state pension. The rise is based on whichever of the following three figures is highest:

- Consumer Price Index (CPI) inflation (measured in September of the previous year)

- Average earnings growth (measured from May to July)

- 2.5% minimum

This ensures that pensions keep pace with the cost of living and wage trends.

“Triple lock protects the value of our retirement income. It’s a vital safeguard,” said a financial analyst in a recent interview.

Why It Matters?

Without the triple lock, pensioners would risk falling behind rising living costs, particularly during periods of inflation. For example, due to earnings growth, the pension rose by 4.1% in April 2025 and is projected to rise another 4.8% in April 2026.

Could the Triple Lock Be Removed?

While debated in times of fiscal pressure, the triple lock has been consistently maintained. Any decision to remove it would require parliamentary approval and likely face strong political opposition given the impact on millions of pensioners.

How Much Will the State Pension Increase in 2026/27?

Based on confirmed wage growth data, the full new State Pension is expected to rise to approximately £241.30 per week from April 2026.

This represents an annual increase of more than £570, reinforcing the fact that pension values are moving upwards rather than downwards.

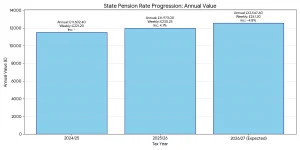

Table: State Pension Rate Progression

Tax Year Weekly Amount Annual Value Increase

2024/25 £221.20 £11,502.40 –

2025/26 £230.25 £11,973.00 4.1%

2026/27 (Expected) £241.30 £12,547.60 ~4.8%

These figures directly contradict claims of reductions and demonstrate how the triple lock continues to operate as intended.

Does Everyone Receive the Full State Pension?

Not everyone receives the full State Pension. While £230.25 per week is the maximum rate under the new State Pension system, the amount an individual gets depends on their National Insurance (NI) record and work history.

Some people receive less because they have fewer than 35 qualifying NI years, were contracted out of the State Pension before 2016, or had gaps in contributions due to career breaks, illness, or caring responsibilities.

Others may receive more than the standard rate. This includes individuals with Additional State Pension entitlements from pre-2016 contributions or those with “protected payments” earned under the old system.

As one recent retiree explained, after working part-time and taking time off to raise children, they built up only 29 qualifying years and now receive around £190 per week, showing how personal circumstances affect outcomes.

What’s Really Changing – Is It the Age, Not the Amount?

Contrary to many public fears, the most impactful policy changes concerning the State Pension relate to when individuals can begin claiming their pension, not how much they receive. The pension value itself has consistently increased, but the State Pension age is rising gradually, and this is where confusion often begins.

The current age to claim the State Pension is 66 for both men and women. However, this is part of a scheduled series of increases designed to ensure the system remains financially sustainable as life expectancy continues to grow.

State Pension Age Timeline:

Period State Pension Age

Present 66

2026–2028 Increasing to 67

2044–2046 Planned rise to 68

The rationale behind these changes is driven by long-term affordability and demographic shifts. With more people living longer and retiring earlier, the cost of sustaining a generous state pension for longer lifespans has prompted a policy shift focused on later access rather than lower value.

“People often assume their pension has been cut when in fact the goalposts have just moved. The payment is still there, but the start line is a bit further away,” a pension policy expert explained.

While the pension age increase may require individuals to adjust their retirement planning, it does not impact the value of the payments they are entitled to once eligible.

What Should You Do If You’re Concerned About Your Pension?

For those uncertain about their future pension entitlement or disturbed by conflicting reports, the best course of action is to review your personal pension status using the official tools available. Taking early steps can provide clarity and highlight any actions you may need to take before retirement.

Key actions to consider:

- Check your State Pension forecast via the official UK government service

- Review your National Insurance record for missing or incomplete years

- Consider voluntary NI contributions to fill gaps where eligible

- Explore Pension Credit, particularly if you’re on a low income in retirement

- Evaluate the benefits of deferring your State Pension to receive a higher weekly amount

There is often time to correct contribution gaps or claim eligible credits. For example, caregivers may be able to apply for specified adult childcare credits or other NI reliefs that significantly boost entitlements.

Being proactive is not just smart, it’s financially rewarding. The earlier these checks are made, the more options you’ll have to optimise your retirement income.

How to Spot Fake News About State Pensions?

The rise in online content has brought with it a wave of unverified and sensationalist claims, many of which cause unnecessary fear among pensioners. While legitimate updates are typically issued through official channels and covered by mainstream financial news, fake reports often circulate first on social media or unknown websites.

Signs of Misinformation

- Headlines using alarming language, e.g., “Pensions slashed!”

- No sources or links to government data

- Contradictory to recent official updates

- Shared through unofficial social media pages or forums

- Poor spelling or formatting, suggesting AI-generated content

“The scariest thing about pension misinformation is how fast it spreads. A single unverified post can spark real panic,” commented a financial literacy advocate.

To Avoid Falling Victim to Misinformation

- Always cross-check claims against reputable news or government portals

- Don’t rely on screenshots or posts without dates or source links

- Be cautious of “breaking news” that hasn’t appeared in national outlets

If you receive information about changes to your pension, verify it first. Misleading content can be emotionally charged but lacks the backing of official data.

FAQs About UK State Pension

What is the full new state pension amount for 2025/26 and 2026/27?

In 2025/26, it’s £230.25 per week. It’s projected to rise to £241.30 per week in 2026/27 under the triple lock.

Will the state pension age rise to 68?

Yes, it is scheduled to rise to 68 between 2044 and 2046, though this may be reviewed based on affordability and life expectancy.

Why do some people get less than £230.25 per week?

This usually results from having fewer than 35 qualifying years of National Insurance contributions or being previously contracted out.

How can I check my state pension forecast?

You can check it online using the UK government’s pension forecast service through the Government Gateway.

Can I increase my state pension amount?

Yes, by making voluntary NI contributions, claiming eligible credits, or deferring your pension once eligible.

Is the triple lock guaranteed to stay in the future?

While it’s currently in place, the triple lock is a policy decision and could be modified in future budgets, though such changes would face strong scrutiny.

How do I know if I was contracted out?

Your past payslips or pension statements will indicate contracted-out status, especially before 2016. You can also check with HMRC.