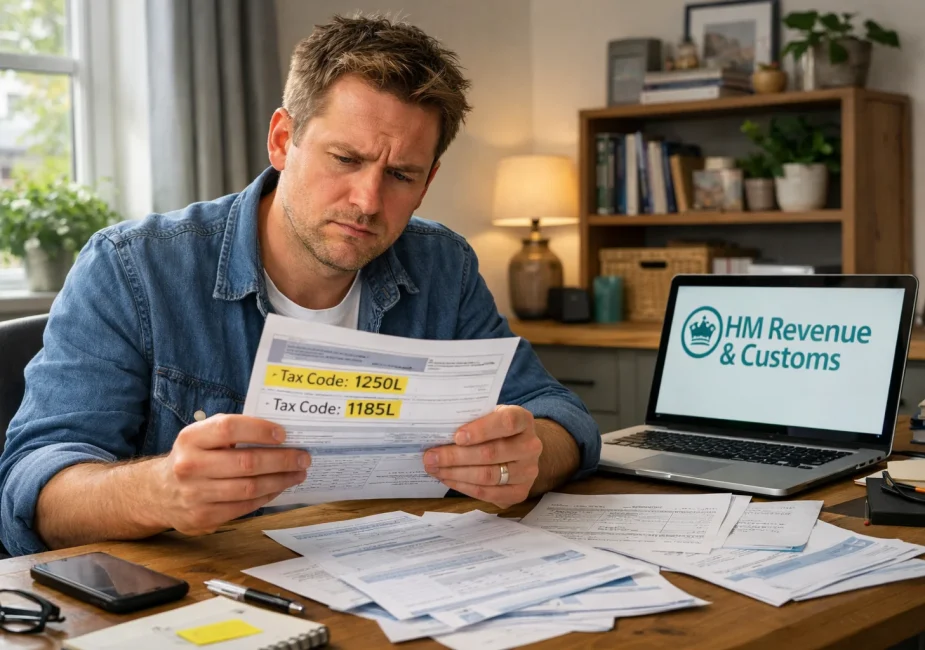

Why Has My Tax Code Changed From 1250L to 1185L?

When I first noticed that my tax code had changed from 1250L to 1185L, I was confused and slightly alarmed. What did this drop mean, and why was more tax suddenly being deducted from my payslip?

As it turns out, this change signifies that your tax-free personal allowance has been reduced by £650, which means you’ll pay more tax over the year. This isn’t an error, it’s HMRC’s way of collecting tax owed or adjusting for new financial circumstances.

Here’s what the change generally means:

- Your personal allowance has dropped from £12,500 to £11,850

- You’ll pay approximately £130 more in income tax annually

- Common triggers include untaxed income, job benefits, or previous underpayments

Let’s break it all down.

What Is a Tax Code and Why Does It Matter?

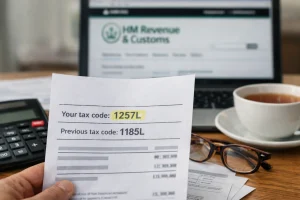

A tax code is used to tell an employer or pension provider how much income tax should be deducted from pay. It is issued by HM Revenue and Customs (HMRC) and is usually made up of a number and a letter, such as 1250L or 1185L. Even small changes to a tax code can have a noticeable impact on take-home pay.

The number in a tax code shows how much income can be earned tax-free, known as the Personal Allowance. This is worked out by adding a zero to the number. The letter gives additional information about how tax should be applied.

For example:

- L means the standard Personal Allowance applies

- BR means all income is taxed at the basic rate

- K means tax is being collected on additional income or benefits

Because the tax code controls how much tax is deducted, an incorrect code can result in overpaying or underpaying tax.

What Does a Change From 1250L to 1185L Actually Mean?

A change from 1250L to 1185L means your tax-free Personal Allowance has been reduced by £650. As a result, a larger portion of your income is taxed, which usually leads to higher deductions from your salary or pension. For someone in the 20% basic rate tax band, this typically works out at around £130 extra tax per year.

Understanding your tax code helps explain why this happens. Tax codes are issued by HM Revenue and Customs (HMRC) and tell your employer or pension provider how much income tax to deduct.

The number shows your tax-free allowance (add a zero to decode it), while the letter provides extra context:

- 1250L = £12,500 tax-free income

- 1185L = £11,850 tax-free income

This reduction is often applied automatically by HMRC to collect unpaid tax, account for benefits-in-kind, or reflect additional income. Unless corrected, the lower code remains in place until HMRC issues a new one.

Who Is Most Likely to See Their Tax Code Lowered?

A tax code change isn’t random. It’s often based on data HMRC receives from your employer or from previous tax returns.

You’re more likely to receive the 1185L code if:

- You have untaxed savings interest or investments.

- You receive job benefits, like a company car or private medical insurance.

- You started receiving the State Pension.

- You have multiple income sources, such as a second job or freelance income.

- HMRC is recovering underpaid tax from previous years.

What Are the Possible Reasons for a Tax Code Change From 1250L to 1185L?

Understanding why your tax code has dropped from 1250L to 1185L is crucial to staying on top of your financial responsibilities and avoiding unexpected tax bills.

A reduction in your tax code means that HMRC believes you owe more tax than previously anticipated, and they’re making adjustments to ensure it’s collected throughout the year, not just at the end.

Let’s explore the most common reasons why HMRC may reduce your Personal Allowance by £650, resulting in this tax code change.

1. Underpaid Tax from a Previous Year

One of the most frequent reasons for a lower tax code is unpaid tax from the previous tax year. HMRC refers to this process as “coding out”, which means they adjust your current year’s tax code to recover tax arrears without requiring a lump sum payment.

For example, if you owe £650 in unpaid tax, HMRC will reduce your tax-free Personal Allowance by £650, changing your code from 1250L (£12,500) to 1185L (£11,850). This results in a gradual recovery over the course of the year, rather than a sudden hit.

A representative from HMRC explained:

“We try to avoid large surprise bills at year-end. It’s often better for people to pay small amounts each month through their PAYE code.”

This adjustment benefits many taxpayers by smoothing out the financial impact, but it also underscores the importance of checking previous tax years for underpayments.

2. Untaxed Interest on Savings and Investments

If you earn untaxed income, such as interest on savings, dividends, or returns from investments, HMRC will reduce your Personal Allowance accordingly to ensure this income is taxed correctly.

This applies when:

- Your interest income exceeds your Personal Savings Allowance

(£1,000 for basic rate taxpayers, £500 for higher rate). - You receive dividends above the tax-free dividend allowance.

- You earn from other sources, like peer-to-peer lending, shares, or cryptocurrency returns.

Instead of issuing a Self Assessment requirement for everyone, HMRC uses PAYE adjustments to collect the tax owed on this untaxed income.

For instance, if you earn £700 in interest from a savings account, HMRC may deduct £700 from your tax-free allowance, which could reduce your code by 70 points, leading to a code such as 1180L.

This is especially common for:

- Landlords with rental income not taxed at source

- Individuals with investment portfolios

- Retirees receiving savings interest alongside pensions

HMRC aims to estimate and collect this tax efficiently to avoid underpayments building up.

3. Job Benefits (Benefits-in-Kind)

Many employers offer non-cash benefits, also known as Benefits-in-Kind (BiK). These perks are considered taxable income and reduce your Personal Allowance when applied through your tax code.

Common examples include:

- Company cars

- Fuel cards or allowances

- Private medical insurance

- Accommodation or relocation support

If your employer provides you with a company car valued at £2,000 in taxable benefit terms, your tax-free allowance will be reduced by the same amount. This could drop your tax code from 1250L to around 1050L, depending on the value assigned to that benefit.

Employers are responsible for reporting these benefits to HMRC via P11D forms. Once submitted, HMRC updates your code to reflect the value of the perks.

This system ensures that you pay tax on all taxable income, not just what you see on your payslip.

4. Multiple Jobs or Pensions

If you’ve started a second job or are receiving multiple pensions, HMRC may redistribute or reduce your Personal Allowance to ensure accurate taxation across all income sources.

Here’s how it typically works:

- Your main job receives your full Personal Allowance via code 1257L (or 1250L/1185L depending on adjustments).

- Your secondary income is often taxed using:

- BR (basic rate – 20%)

- D0 (higher rate – 40%)

- 0T (no allowance)

If HMRC doesn’t have accurate or timely information, they might reduce your overall allowance to avoid potential underpayment.

This applies to:

- People juggling multiple part-time roles

- Retirees drawing from a private pension and State Pension

- Professionals with employment plus freelance or consulting work

In these cases, HMRC adjusts your code to collect tax evenly across all income sources.

5. Starting to Receive the State Pension

The State Pension is taxable, but unlike employment income, it is not taxed at source. That means HMRC must apply a tax adjustment elsewhere to ensure you’re paying what you owe.

This typically affects:

- Individuals reaching State Pension age while still working

- Pensioners receiving both State and private pensions

If you begin receiving £9,000 in State Pension annually, HMRC will reduce your Personal Allowance by that amount on your private pension’s tax code, ensuring tax is collected from the source where it can be.

So, if you previously had a 1250L code for your private pension, it may drop significantly, potentially below 1185L, to account for the untaxed pension income.

This adjustment prevents tax underpayments that would otherwise occur at year-end.

6. Estimated or Outdated Income Figures

Sometimes tax code changes happen not because of actual income changes, but because HMRC is working with outdated or inaccurate estimates.

Examples include:

- An old side business or freelance income no longer active

- A previously held benefit that is no longer received

- Income figures submitted late or inaccurately by employers

Sarah, a self-employed marketer, shared:

“I hadn’t worked freelance in over a year, but HMRC still counted it. Once I updated them, my code was corrected.”

If HMRC believes you are still earning from a previous income source, they will proactively reduce your Personal Allowance. While this is done to prevent underpayment, it can result in over-taxation if not corrected.

That’s why regularly reviewing your tax code and using the HMRC Personal Tax Account is so important.

7. Emergency or Temporary Tax Codes

If you’ve recently started a new job and your employer hasn’t received a P45 or the necessary tax information from HMRC, you might be placed on an emergency tax code, such as 1185L W1/M1.

These emergency codes:

- Treat each payday in isolation (Week 1 or Month 1)

- Ignore previous income and tax paid in the current year

- Often result in more tax being deducted than necessary

Emergency tax codes are temporary, but they can significantly reduce take-home pay until corrected. Once HMRC receives your employment history or you submit a new P45, they can update your code.

If you’re unsure why your code includes “W1” or “M1,” check with your employer and review your P2 notice on your HMRC account.

Summary Table: Tax Code 1250L to 1185L – Key Reasons

Reason Description

Underpaid Tax from Prior Year HMRC reduces your allowance to collect owed tax gradually

Untaxed Interest or Investments Interest, dividends, and returns not taxed at source reduce your tax-free limit

Job Benefits (Company Car, etc.) Non-cash benefits reduce your allowance proportionally

Multiple Jobs or Pensions HMRC reallocates allowance across income sources

Starting to Receive State Pension Pension taxed indirectly by reducing other income allowance

Estimated or Outdated Income Data HMRC uses previous income estimates to adjust your code

Emergency/Temporary Codes Default codes applied when records are missing; usually result in higher tax

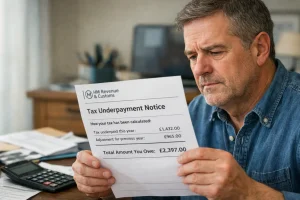

How Much More Tax Will You Pay with the 1185L Code?

When your tax code drops from 1250L to 1185L, you’re effectively losing £650 of tax-free income for the year. For most employees, this means more of your salary becomes taxable, even though your overall income hasn’t changed.

This adjustment usually reflects HMRC’s attempt to collect tax on untaxed income or correct a previous underpayment.

For a basic rate taxpayer (20%), this means:

- You’ll pay £130 more in tax over the tax year.

- That equates to around £10.83 more per month, deducted directly from your salary.

Even if this increase seems small, it can have a knock-on effect on monthly budgeting, particularly if you’re also managing expenses like childcare, mortgage repayments, or rising living costs.

If you’re in a higher tax band or nearing the £100,000 income threshold, the impact could be greater due to the tapering of the personal allowance.

This makes it all the more important to check that your tax code reduction is justified.

How Can You Check If Your Tax Code Is Correct?

Confirming the accuracy of your tax code is easier than many people think, and doing so can save you from unnecessary deductions or a surprise tax bill later on.

Start by examining:

- Your payslip: The code is usually listed at the top or near your National Insurance number.

- Your HMRC P2 Coding Notice: This explains the breakdown of your tax code and any deductions or benefits included.

- Your Personal Tax Account on GOV.UK: A free tool that provides a detailed view of how your code is calculated and what HMRC believes you’re earning.

P2 Coding Notice Section Explanation

Personal Allowance Shows your annual tax-free income

Deductions Lists untaxed income or job benefits

Adjustments Displays underpaid tax added back

Income Estimate Projects your total income for the year

If something looks wrong, such as outdated job roles, double entries, or benefits you no longer receive, then it’s worth contacting HMRC for clarification. Inaccuracies in this data are one of the most common causes of incorrect tax codes.

What Should You Do If Your Tax Code Is Wrong?

If you think your tax code is incorrect, don’t wait for HMRC to fix it on their own. Errors can result in months of overpaid tax, or worse, an unexpected underpayment that catches up with you at year-end.

Here’s how you can take action:

- Review your coding notice carefully. Double-check that all deductions, benefits, and income figures are accurate.

- Log into your HMRC Personal Tax Account. This will help you compare your actual income against HMRC’s records.

- Contact HMRC via phone, online chat, or by writing. Be ready with your NI number, employer details, and recent payslips.

- Speak with your employer if the issue involves benefits like a company car, health insurance, or other perks.

“One quick call to HMRC saved me over £100 in the long run. They had included an old benefit I no longer received,” said David, a marketing consultant.

Once the issue is resolved, HMRC will reissue a corrected code, and your employer will automatically apply it in your next payroll cycle.

Can You Prevent Future Tax Code Errors?

Yes, many tax code errors can be avoided by staying proactive and keeping HMRC informed of changes to your personal and financial situation. Incorrect tax codes often occur when HMRC is working with outdated information, especially after changes in employment, income, or benefits.

To reduce the risk, it’s important to notify HMRC promptly about job changes, new income sources, or adjustments to benefits. Reviewing your tax code regularly, particularly after starting a new role, receiving a pay rise, or taking on freelance or investment income, can help spot issues early.

Submitting your P45 when changing jobs also reduces the chance of emergency tax codes. Keeping track of benefits like company cars or private healthcare is equally important, as these directly affect your tax-free allowance. Ignoring these steps can result in overpaying tax or unexpected bills later.

Why Might Your Tax Code Change Even If Nothing Has Changed?

This is a question many people ask, and it’s a fair one. If your salary, job, and financial situation have remained stable, seeing a drop in your tax code can feel frustrating or even alarming.

But HMRC often works with estimated or previously reported data, especially if they haven’t received new updates from your employer or pension provider. Even if nothing has changed on your end, changes might be triggered by:

- HMRC using last year’s income figures.

- Late or amended employer benefit submissions.

- Duplicate jobs or income entries on your record.

- Adjustments to previous underpaid or overpaid tax.

If your tax code doesn’t reflect your current income, challenge it. You’re entitled to a review, and in most cases, HMRC can adjust the code within a few weeks.

“I hadn’t changed a thing, but my code dropped. Turns out HMRC thought I still had a second job I left a year ago,” – Emma, Bristol

Always trust your instincts, if something feels off, it probably is.

Where Can You Find a Full List of UK Tax Codes and Their Meanings?

Understanding the full landscape of tax codes can help you make sense of what yours means and how it compares to others.

Here’s a useful table of common UK tax codes:

Tax Code Meaning

1257L Standard personal allowance for most employees

1185L Reduced allowance due to adjustments or deductions

BR All income taxed at 20% (basic rate) – used for second jobs

D0 All income taxed at 40% (higher rate)

0T No personal allowance applied – typically emergency tax

NT No tax taken – usually temporary or for specific exemptions

K250 Income is treated as £2,500 higher due to deductions exceeding allowances

HMRC also uses region-specific codes like S1185L (Scotland) or C1257L (Wales), which reflect devolved income tax rates.

You can find your tax code meaning by:

- Logging into your Personal Tax Account

- Calling HMRC

- Visiting GOV.UK’s tax code guide

Understanding your code gives you the power to dispute or confirm deductions with confidence.

Conclusion

A tax code change from 1250L to 1185L usually indicates that HMRC is collecting more tax based on updated information. It might involve unpaid tax, benefits, or untaxed income like interest from savings or investments.

By checking your coding notice, reviewing income data, and using HMRC’s online tools, you can spot issues early. If your code seems off, raise it with HMRC or your employer.

Proactive monitoring and clear communication can help you stay in control of your income and ensure you’re paying exactly what’s required, nothing more.

Frequently Asked Questions

How does Marriage Allowance affect my tax code?

If your partner transfers part of their unused personal allowance to you, your tax code could increase (e.g., from 1257L to 1374M), reducing your tax bill.

Will I get a refund if my tax code was too low all year?

Yes. HMRC will usually refund overpaid tax at the end of the year, or you can claim it sooner using your Personal Tax Account.

What is a K tax code and should I be worried about it?

A K code means your deductions exceed your personal allowance. It doesn’t necessarily mean trouble—but it does mean more tax is being taken upfront.

Can untaxed rental income change my tax code too?

Yes. HMRC may lower your tax code to account for rental income if it’s not taxed through Self Assessment.

How do I check what my tax code includes?

Login to your Personal Tax Account and view your current tax code breakdown under “PAYE.”

Does my tax code change if I go self-employed?

No tax code is used if you’re solely self-employed. However, any employment income alongside self-employment may still require a PAYE code adjustment.

How often does HMRC update or review tax codes?

Typically once a year, but changes can occur any time HMRC receives new information about your income or benefits.