UK State Pension Cut 2025 – Is the Government Really Reducing Payments?

The topic of UK pensions continues to stir debate, especially with widespread claims online suggesting that the UK state pension is being slashed in 2025.

For pensioners, workers nearing retirement, and policy watchers alike, these claims can cause confusion and concern. But how much truth is there to the reports? Has the government really confirmed a reduction, or is the reality more complex, and far less dramatic?

This blog breaks down the facts surrounding the UK state pension cut 2025, explores what has actually changed for the 2025/26 tax year, and discusses what UK pensioners, especially those in London, need to know moving forward.

What is the Confirmed UK State Pension Amount for 2025/26?

In clear terms, the UK state pension has not been cut in 2025. In fact, it has increased. From April 2025, the full new State Pension rose to £230.25 per week, up from £221.20 in 2024/25.

This change continues the government’s adherence to the Triple Lock policy, ensuring pension payments keep pace with the cost of living.

| Tax Year | Full New State Pension (Weekly) | Annual Equivalent |

|---|---|---|

| 2024/25 | £221.20 | £11,502.40 |

| 2025/26 | £230.25 | £11,973.00 |

This increase means eligible pensioners are now receiving an additional £9.05 per week, or £470.60 more annually.

It’s important to note that this full amount is only available to individuals who have made at least 35 qualifying years of National Insurance (NI) contributions. Those with fewer qualifying years may receive a lower amount.

Has the Government Actually Announced a Pension Cut in 2025?

Despite some alarming headlines and social media rumours, no official announcement of a UK state pension cut has been made for 2025. On the contrary, the Department for Work and Pensions (DWP) has confirmed that pensions have increased in line with the Triple Lock, as promised.

Claims of a £140 per month “cut” are not based on factual announcements. Instead, these figures may have stemmed from misinterpretations of complex tax implications or hypothetical scenarios regarding future pension reform discussions.

There is no generalised cut to pension amounts for 2025. However, it’s crucial to understand that individual pension amounts can vary depending on one’s contribution history, tax liability, and other income.

Where Did the £140-a-month Pension Cut Rumour Come From?

The £140 monthly cut figure, which appeared in various news stories and social media posts in late 2025, seems to have originated from a mix of confusion, speculation, and misunderstanding of real changes.

While it’s true that some pensioners may feel like they’re receiving less after taxation, particularly those with other income sources, this is not the result of a policy decision to reduce the pension rate.

Rather, it reflects:

- Tax thresholds that haven’t risen in line with pension increases

- Individual circumstances, such as private pensions pushing total income into a taxable range

- Media confusion over proposed future changes, not actual 2025 policy

For example, some stories may have extrapolated a scenario where future pension reforms tie increases to earnings only, which could result in lower rises than inflation-based calculations under Triple Lock. But again, this has not been implemented.

How Does the Triple Lock Policy Protect Pensions in 2025?

The Triple Lock is a government commitment to raise the State Pension each year by whichever is highest:

- Inflation (as measured by the Consumer Prices Index)

- Average wage growth

- 2.5%

In 2025, strong wage growth triggered the Triple Lock, leading to the £230.25/week pension increase. The policy is designed to preserve pensioners’ purchasing power, especially during periods of rising living costs.

Will the Triple Lock Continue in Future Years?

There is ongoing political and economic debate about the long-term affordability of the Triple Lock. Organisations like the Institute for Fiscal Studies (IFS) have proposed alternatives, including linking pension increases solely to earnings, as a more sustainable approach.

However, as of now, the government remains committed to maintaining the Triple Lock through 2025/26. Any changes to this policy would require parliamentary debate and public consultation.

Why Do Some Pensioners Receive Less Than the Full Amount?

Not every pensioner receives the full £230.25 weekly rate. One of the most common reasons for receiving less is an incomplete National Insurance contribution record.

To qualify for the full new State Pension, individuals typically need:

- At least 35 qualifying years of National Insurance contributions

- A minimum of 10 qualifying years to receive any pension at all

If you have gaps in your NI record, for example, due to time spent out of work, raising children, or working abroad, you may receive a reduced pension.

| Years of NI Contributions | Estimated Weekly Pension |

|---|---|

| 10 years | Approx. £65–£70 |

| 20 years | Approx. £130–£140 |

| 35+ years | Full rate (£230.25) |

How to Check Your Pension Entitlement?

Pensioners and future retirees can use the government’s official pension forecast service to check their:

- Estimated State Pension amount

- Years of NI contributions

- Options for making voluntary top-ups

This transparency helps individuals take early action if there are gaps that could reduce their retirement income.

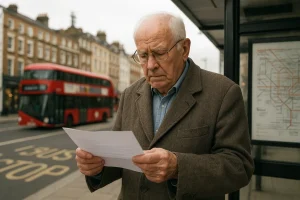

What are the Latest Pension Changes Affecting London Pensioners?

Living in London brings unique financial challenges, particularly for pensioners managing housing costs, council tax, and general expenses on a fixed income.

While the national State Pension applies uniformly, London pensioners often face higher living costs that make these increases feel insufficient.

Several considerations specific to pensioners in the capital include:

- Eligibility for Pension Credit: This means-tested benefit can supplement the income of pensioners who do not receive the full State Pension, offering crucial support in high-cost areas like London.

- Council Tax Reductions: Pensioners may qualify for local authority council tax support schemes, especially those living alone or with low income.

- Additional Housing Support: Renters in London can apply for Housing Benefit or Universal Credit, which may help with rising rental prices.

It’s vital for London residents to access local advice services to ensure they are claiming all available entitlements. Small increases in the national pension may not be enough to offset urban cost-of-living pressures, so localised support remains essential.

Are Long-term Pension Reforms or Age Changes on the Horizon?

While 2025 has brought a confirmed increase in UK State Pension payments, longer-term reforms are already on the horizon. The government continues to review how the pension system can remain sustainable as people live longer and public finances face pressure.

One major change is the planned rise in the State Pension Age to 67 between 2026 and 2028. This will mainly affect people born after April 1960, meaning they will need to wait longer before they can claim their pension.

Further changes are also expected for those living overseas. From April 2029, access to cheaper Class 2 voluntary National Insurance contributions will end, increasing costs for topping up records. At the same time, a wider review of voluntary contribution rules is underway to improve fairness.

What Should You Do if You’re Unsure About Your Pension?

If you’re uncertain about your pension entitlement, there are several actions you can take now to improve clarity and outcomes.

Consider the following steps:

- Use the online State Pension forecast tool to see your projected pension.

- Review your NI record to identify any gaps or shortfalls.

- Make voluntary NI contributions where appropriate to increase your future pension.

- Speak to a pensions adviser if your situation is complex, particularly if you’ve worked abroad, taken career breaks, or are self-employed.

Proactive steps today can make a significant difference to your retirement income tomorrow.

Conclusion – Is your State Pension under threat in 2025?

In summary, there is no UK state pension cut in 2025. On the contrary, the full new State Pension has increased to £230.25 per week, thanks to the Triple Lock.

Rumours of a £140 monthly reduction are unfounded and appear to result from confusion over tax implications or speculative reforms, not confirmed policy.

That said, the long-term future of the pension system is under review. With changes to SPA, voluntary contributions, and affordability debates ongoing, it’s essential to stay informed, proactive, and engaged with the latest developments.

For London pensioners, in particular, accessing local financial support and understanding regional benefits will be critical in ensuring that retirement remains financially manageable.

Frequently Asked Questions

How do I know if I’m eligible for the full new State Pension?

Eligibility depends on your National Insurance record. You need 35 full qualifying years to get the full amount and at least 10 years to receive anything.

Can pension income push me into a higher tax bracket?

Yes. If your total income (including private pensions and other sources) exceeds your Personal Allowance (£12,570 in 2025/26), you may have to pay income tax on the excess.

What if I lived or worked abroad, will that affect my pension?

Time spent abroad may result in gaps in your National Insurance record. However, you can often make voluntary contributions to cover these periods.

How can I boost my pension if I haven’t paid enough NI?

You can pay voluntary Class 3 contributions to fill recent gaps (up to six years). Check your eligibility and costs via the online pension forecast.

Is the State Pension rising faster than inflation in 2025?

Yes. For 2025, strong wage growth triggered the Triple Lock, leading to a rise above inflation and the 2.5% minimum increase threshold.

Are future pension increases guaranteed after 2025?

While the government has confirmed the Triple Lock for 2025/26, discussions about reform continue. There’s no guarantee it will remain unchanged in future years.

What resources are best for checking pension entitlements?

The government’s online State Pension forecast tool is the most reliable source. It provides a detailed breakdown of your entitlement and NI record.