UK National Living Wage 2026 Estimate: Latest Government Projections

The UK Government has published the Low Pay Commission’s remit for the National Minimum Wage (NMW) and National Living Wage (NLW) rates that will apply from April 2026.

The focus remains on ensuring that the NLW does not fall below two-thirds of the median hourly earnings, in line with the Government’s long-term strategy for improving living standards and economic stability.

This blog explores the estimated figures for the 2026 NLW, the underlying methodology, and the broader implications for businesses, workers, and the economy.

The projections are part of a broader wage policy landscape that balances worker welfare with economic resilience.

What Is The UK’s National Living Wage?

The National Living Wage (NLW) is the legal minimum hourly pay that workers aged 21 and over must receive in the United Kingdom.

It is set by the government but guided by independent advice from the Low Pay Commission (LPC). The NLW is part of a wider strategy to reduce low pay and improve income equality.

Since its introduction in 2016, the NLW has gradually increased to keep pace with inflation and economic growth. Unlike the National Minimum Wage (NMW), which applies to younger workers and apprentices, the NLW is designed to offer a higher wage floor for adults.

The process for determining the NLW involves several economic and social factors:

- Analysis of wage growth across various sectors

- Inflation forecasts provided by the Office for Budget Responsibility

- The cost of living and household affordability

- Employment levels and business feedback

The Low Pay Commission uses a blend of statistical data and real-world consultation to recommend rates that promote fair pay without harming employment.

Why Is Two-Thirds Of Median Earnings The Benchmark For The 2026 Estimate?

The government has committed to ensuring that the NLW does not fall below two-thirds of UK median hourly earnings. This benchmark is widely regarded as a meaningful threshold for identifying low hourly pay and assessing economic fairness.

Using this ratio as a target offers several benefits:

- It ties wage policy directly to national income levels

- It allows for automatic adjustment in line with broader wage trends

- It creates a standardised approach that avoids arbitrary increases

This target is not a rigid formula. The LPC is still expected to weigh a range of economic conditions, such as business capacity, inflation, and the wider labour market. However, the two-thirds measure acts as a guiding principle that supports long-term policy consistency.

What Is The Projected National Living Wage For April 2026?

According to the latest figures published by the government, the projected National Living Wage for April 2026 is as follows:

| Estimate Type | Projected Rate |

|---|---|

| Central Estimate | £12.71 |

| Lower Range | £12.55 |

| Upper Range | £12.86 |

These estimates are based on updated data showing stronger-than-expected wage growth during 2025. The central projection of £12.71 represents a 4.1 percent increase over the current rate of £12.21, which was introduced in April 2025.

The government had previously forecast a lower estimate of £12.65, but this was revised upward after observing more robust wage performance. The increase also reflects the need to maintain the NLW at or above two-thirds of median earnings, which has also seen growth.

This estimated range accounts for various scenarios in wage and productivity changes. It is important to note that the final rate will depend on continued economic monitoring through the remainder of 2025.

How Do Economic Conditions Influence The Final Recommendation?

The Low Pay Commission uses a data-driven, flexible framework to evaluate the appropriate National Living Wage each year. Economic conditions are central to this process, shaping both the short-term feasibility and long-term sustainability of any proposed wage increase.

Wage Growth Trends And Forecasts

Wage growth plays a critical role in shaping NLW recommendations. The Low Pay Commission examines national wage data to determine whether the economy can support an increase in the statutory minimum.

In 2025, stronger-than-expected wage growth has already pushed the NLW estimate higher. The central assumption is that year-on-year wage growth was 5.1 percent in May 2025, with forecasts suggesting 3.9 percent in Q4 2025 and 3 percent in Q4 2026.

If wages continue rising at this pace, the NLW may exceed the current central estimate of £12.71.

Inflation And Cost Of Living

Inflation affects both the real value of wages and household purchasing power. The Low Pay Commission must ensure that any increase to the NLW helps workers keep pace with rising prices, without fueling inflationary pressure across the economy.

If inflation is high and earnings lag behind, the real value of the NLW can erode, undermining its intended impact. Conversely, a moderate inflation environment allows for more predictable and sustainable wage increases.

Labour Market Performance

The Commission assesses employment levels, job creation rates, and productivity to determine whether businesses, especially those in low-wage sectors, can absorb wage increases without cutting jobs or hours.

In a strong labour market with high employment, there is more scope to raise the NLW. However, in periods of economic uncertainty or declining job growth, aggressive wage increases may have unintended consequences.

Business Health And Sectoral Pressures

Business feedback is a critical part of the LPC’s consultation process. Wage pressures impact sectors differently, with industries such as hospitality, retail, and social care often facing the greatest challenges.

The Commission evaluates:

- Profitability margins across sectors

- Likelihood of staff reductions or automation

- Regional variations in business conditions

These factors help strike a balance between protecting workers and maintaining the competitiveness of UK businesses.

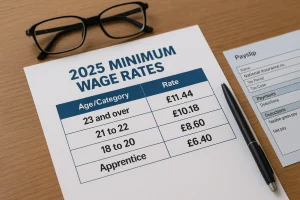

What Are The Current Minimum Wage Rates As Of April 2025?

Understanding the current wage structure helps frame the significance of future projections. The minimum wage rates as of April 2025 are outlined below:

| Age/Category | Hourly Rate | Increase (£) | Increase (%) |

|---|---|---|---|

| National Living Wage (21+) | £12.21 | £0.77 | 6.7% |

| 18–20 Year Old Rate | £10.00 | £1.40 | 16.3% |

| 16–17 Year Old Rate | £7.55 | £1.15 | 18.0% |

| Apprentice Rate | £7.55 | £1.15 | 18.0% |

| Accommodation Offset | £10.66 | £0.67 | 6.7% |

The largest percentage increases are seen in the youth and apprentice categories, reflecting the government’s aim to boost entry-level wages and close the gap between age bands.

These increases also align with broader policy goals to ensure that younger workers are not disproportionately affected by rising living costs.

How Does The 2026 National Living Wage Estimate Affect UK Businesses And Workers?

The estimated rise in the National Living Wage to a central figure of £12.71 has far-reaching implications for both employers and employees. While the intention is to raise living standards, the effects will vary depending on industry, workforce size, and operating models.

Impact On Workers

For workers, particularly those in traditionally low-paid roles, the increase offers several benefits:

- Improved Living Standards: A higher hourly rate can enhance financial security, enabling workers to better cope with housing, utilities, and food costs.

- Reduced In-Work Poverty: Increases in the NLW can help close the income gap and lift more individuals above the poverty threshold.

- Workplace Retention: A more competitive base wage can improve job satisfaction and reduce staff turnover, particularly in sectors with high attrition rates.

However, if employers respond by cutting hours or tightening job criteria, some workers may see reduced access to shifts or fewer opportunities.

Impact On Businesses

For employers, the effects of a higher NLW vary based on operational capacity and labour intensity.

Payroll Costs And Profitability

An increase to the NLW directly raises payroll expenses. For large businesses, this may be manageable, but small and medium-sized enterprises (SMEs) may struggle to absorb the added costs.

- Labour-intensive sectors such as hospitality, retail, and care will likely face the steepest impact

- Businesses may need to reassess staffing structures, operational hours, or service pricing

Business Adaptation Strategies

To cope with higher wage obligations, businesses may:

- Invest in automation to reduce dependence on manual labour

- Shift towards higher-value services or products to justify increased costs

- Redesign shift patterns or staffing models for greater efficiency

Some may also pass additional costs to consumers through pricing adjustments, particularly in sectors with narrow profit margins.

Balancing Worker Welfare With Economic Viability

The Low Pay Commission aims to deliver outcomes that benefit workers without undermining the health of the broader economy. Its remit encourages a balanced approach that considers the needs of employees and the capacity of businesses to implement wage increases responsibly.

By analysing input from both business groups and worker representatives, the Commission strives to propose rates that achieve economic fairness while supporting business continuity and job preservation.

What Are The Next Steps Before The 2026 Rates Are Finalised?

The process to finalise the NLW and NMW rates for 2026 is already underway. The Low Pay Commission is currently conducting its final round of economic analysis and stakeholder engagement.

The steps ahead include:

- Ongoing data analysis through summer and early autumn 2025

- Stakeholder consultations with employer groups, unions, and economists

- Submission of formal recommendations by the end of October 2025

- Government review and final decision-making by early 2026

- Implementation of new rates from April 2026

Although the current projections provide a helpful indication, the final rate could be adjusted based on new data or unforeseen economic developments.

How Does The UK’s Wage Policy Compare Internationally?

The UK is among a group of advanced economies that maintain a statutory national living wage policy. Comparisons with other countries offer insight into how the UK measures up globally.

Several OECD countries have similar or higher minimum wage standards, including:

- France, where the minimum wage is linked to inflation and productivity

- Australia, which uses a Fair Work Commission to set wages annually

- Germany, where collective bargaining plays a key role

In terms of wage-to-median earnings ratio, the UK performs well, especially with its commitment to maintain the NLW at or above two-thirds of median pay.

However, regional cost-of-living differences mean the NLW may stretch further in some parts of the UK than others.

Global comparisons also highlight the importance of balancing competitiveness with social responsibility in wage-setting policy.

What Are The Challenges In Predicting The 2026 National Living Wage?

Predicting the NLW two years in advance is complex due to economic uncertainty. While projections are helpful for planning, they must be interpreted cautiously.

Key challenges include:

- Unexpected shifts in inflation or global economic conditions

- Changes in employment rates, particularly in low-wage sectors

- Government policy shifts or fiscal constraints

- Technological changes that affect job structures

For example, if inflation rises faster than expected or wage growth slows, the final NLW may fall below current projections.

Conversely, continued strong performance in wage growth could push the rate above £12.86.

These uncertainties highlight why the Low Pay Commission avoids rigid formulas and instead adopts a flexible, evidence-based approach.

Conclusion

The projected UK National Living Wage for April 2026 reflects the government’s continued commitment to aligning pay with economic growth and living standards.

While the central estimate of £12.71 offers insight into future wage policy, it remains subject to change based on evolving economic conditions. Both workers and employers should stay informed as recommendations develop.

The final decision will aim to strike a balance between fair wages and economic sustainability, ensuring the NLW supports both workforce welfare and business competitiveness.

Frequently Asked Questions

What’s the difference between National Minimum Wage and National Living Wage?

The National Minimum Wage applies to workers under the age of 21, while the National Living Wage applies to those aged 21 and above. The NLW is typically higher and reflects a commitment to provide a more sustainable income level for adults.

Who qualifies for the National Living Wage in the UK?

As of April 2024, workers aged 21 and over qualify for the NLW. Previously, it applied only to those aged 23 and over, but the eligibility age was reduced as part of broader wage reforms.

How accurate are government NLW estimates?

NLW estimates are based on economic forecasts and historical trends, but they are not guaranteed. Final rates may differ based on inflation, wage growth, and macroeconomic conditions.

When will the final NLW for 2026 be confirmed?

The Low Pay Commission will submit its final recommendations by the end of October 2025. The government will confirm the new NLW shortly after, for implementation in April 2026.

How is inflation factored into wage estimates?

The Low Pay Commission reviews inflation data and economic forecasts from sources such as the Office for Budget Responsibility (OBR) to inform their projections and ensure wage increases maintain purchasing power.

Does the National Living Wage vary by region in the UK?

No, the NLW is set at a national level and does not vary by region. However, the cost of living does differ across the UK, which can affect how far the wage goes in practical terms.

How can businesses prepare for wage changes?

Businesses should review government updates, assess payroll impacts, update their financial plans, and consider automation or restructuring to manage increasing labour costs effectively.