How to Invest Money and Make Money in 2026?

Is 2026 the year to take bold financial steps, or the time to tread carefully? For many investors across the UK, the economic uncertainties ranging from shifting political power globally to inflation and regional instability — have raised serious questions about how to grow and protect wealth in today’s environment.

Should one continue trusting traditional savings accounts and bonds, or is it time to explore cryptocurrencies, peer-to-peer lending, and angel investing? Is buy-to-let property still a wise strategy, or do investment platforms offer better diversification and returns?

In this guide, we examine where and how to invest money and make money in 2026, carefully analysing investment types based on their risk profiles, potential returns, and alignment with likely economic outcomes. From high-growth digital assets to time-tested income-generating real estate, this comprehensive overview will help UK investors navigate their choices with clarity.

What High-Risk Investments Could Deliver the Highest Returns in 2026?

Investors willing to accept greater volatility and uncertainty may be rewarded with higher returns. These investments, however, require due diligence, strategic thinking, and a clear understanding of both macroeconomic and micro-level risks.

1. Cryptocurrency

Cryptocurrency remains one of the most volatile yet potentially rewarding investment classes available in 2026. As digital assets like Bitcoin and Ethereum gain institutional legitimacy, their price movements are still influenced heavily by speculation, global policy shifts, and investor sentiment. Despite their maturity compared to the broader crypto market, these assets regularly experience large fluctuations.

Other, lesser-known altcoins may offer exponential gains during bull cycles, but they come with an extremely high risk of total loss. These coins often lack liquidity, clear use cases, or community backing, making them vulnerable to manipulation or sudden devaluation.

As the market matures, many investors are starting to treat crypto as a small but strategic allocation within broader portfolios. Blockchain innovations in decentralised finance (DeFi), tokenised assets, and NFTs continue to reshape traditional financial models. However, navigating this ecosystem safely requires robust due diligence.

Key Considerations for Crypto Investing in 2026:

- Volatility: Bitcoin’s annualised volatility remains around 45%, over four times higher than traditional equities.

- Market Drivers: Regulatory news, social sentiment, and macroeconomic indicators heavily influence price.

- Security: Digital wallets must be secured, preferably through hardware or cold storage.

- Taxation: HMRC treats crypto gains as taxable; investors must keep accurate records and report accordingly.

Table: Crypto Risk-Reward Profile

| Asset Type | Potential Returns | Risk Level | Liquidity | Regulatory Status (UK) |

|---|---|---|---|---|

| Bitcoin/Ethereum | 10–100% annually (variable) | High | High | Recognised, taxed as assets |

| Altcoins | Up to 1,000% (highly speculative) | Very High | Low to medium | Varies (many unregulated) |

| Stablecoins | 1–5% (yield-bearing platforms) | Moderate to High | Medium | Under review by FCA |

Investors entering the crypto market in 2026 should ensure they only invest what they can afford to lose and limit exposure to speculative coins. A diversified basket of blue-chip cryptos, combined with knowledge of tax rules and cybersecurity, is essential for responsible participation.

2. Angel Investing Without Tax Relief

Angel investing involves allocating capital to high-potential startups in exchange for equity, typically before they secure significant market traction. While this form of investing can lead to multiples of return, often 2x to 10x, it is inherently high-risk, especially when not backed by EIS or SEIS tax reliefs.

Without these schemes, investors are exposed to full capital risk and receive no mitigation in the event of failure. That said, some investors choose this route to participate more actively in ventures they understand or believe in.

In many cases, angel investors may assume an advisory role, offer strategic guidance, or even contribute to operations, making this investment style hands-on and involved rather than passive.

Factors to Consider Before Angel Investing Without Tax Relief:

- No Tax Protection: Losses cannot be offset through EIS/SEIS, increasing downside exposure.

- Startup Failure Rate: Around 60–80% of startups fail within their first 3 years.

- Time Horizon: Liquidity events (e.g., acquisition or IPO) often take 5–7 years or longer.

- Active Involvement: Often necessary to enhance investment success.

Table: Angel Investment Risk Profile (No Reliefs)

| Factor | With EIS/SEIS | Without Tax Relief |

|---|---|---|

| Income Tax Relief | Up to 50% | None |

| Capital Gains Deferral | Yes | No |

| Loss Relief | Available | Not applicable |

| Risk Mitigation | High (via incentives) | Low |

| Investor Involvement | Optional | Often necessary to reduce failure risk |

Investors pursuing non-tax-relieved angel opportunities must carefully vet the startup’s team, traction, and scalability. Success depends as much on personal engagement as it does on the business model itself.

3. High-Risk Single Stocks

High-risk single stocks especially those in fast-evolving sectors like technology, biotech, or clean energy, have the potential to outperform the market significantly, but they do so at the cost of stability and predictability.

Stocks in this category may react sharply to earnings reports, industry disruptions, or even social media buzz. For instance, a company involved in AI or crypto mining could swing 15–30% in a matter of days based on sentiment alone.

These stocks are ideal for experienced investors who can commit time to market research, risk management, and tactical positioning. Long-term investors, on the other hand, might choose to buy during market corrections and hold with a clear exit plan.

Common Strategies When Dealing With High-Risk Stocks:

- Momentum Trading: Capitalise on short-term price movement, often using technical analysis.

- Value Rebound Plays: Buy fundamentally sound stocks after price dips due to macro pressures.

- Innovation Investing: Focus on companies with long-term technological or healthcare breakthroughs.

When to Consider High-Risk Stocks:

- When you’re comfortable with double-digit daily price swings.

- When you have time to monitor news, earnings, and economic indicators.

- When your portfolio is already diversified and you want exposure to high-growth ideas.

Key Sectors to Watch in 2026:

- Artificial Intelligence and Machine Learning

- Renewable and Clean Energy

- Cybersecurity

- Biotechnology and Genomics

- Digital Infrastructure

Unlike ETFs or diversified funds, high-risk stocks can offer significant upside but often lead to losses without proper risk controls. Investors should never allocate more than a reasonable portion (e.g., 5–10%) of their total portfolio to such assets.

What Are the Best Moderate-Risk Investment Opportunities for 2026?

For investors seeking a balance between risk and return, moderate-risk investment options offer growth potential without the extreme volatility of high-risk assets. These options are often suitable for longer-term strategies and diversified portfolios.

4. Private Equity

Private equity investing offers exposure to privately held companies with high growth potential, often before they become publicly listed. While this area typically requires a medium- to long-term commitment, it has consistently outperformed public markets over the last two decades. Data shows private equity funds have delivered average annual returns of over 13%, outperforming public indices like the S&P 500.

Investing in private equity, however, is not liquid. Returns are realised through exits—such as company sales or IPOs—which can take several years. For UK investors, platforms offering access to private equity via diversified funds or syndicate investments provide new ways to engage without the traditional barriers of high minimum investments.

5. EIS and SEIS Investments

For UK investors seeking high-growth opportunities while benefiting from generous tax reliefs, the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) remain two of the most valuable tools in 2026.

Both schemes were introduced by the UK government to encourage investment into early-stage businesses, but they target companies at different stages of growth and offer distinct tax benefits.

EIS is designed for businesses that are slightly more developed, while SEIS is geared towards brand-new startups, making it riskier but potentially more rewarding due to enhanced reliefs.

These schemes are particularly useful for high-net-worth individuals, experienced investors, or those looking to diversify into early-stage venture capital without assuming the full weight of the risk. Both EIS and SEIS can significantly reduce your exposure to loss through income tax relief, CGT deferrals, and loss relief.

Here’s a clear breakdown of the key differences between the two:

EIS vs SEIS Comparison Table

| Feature | EIS (Enterprise Investment Scheme) | SEIS (Seed Enterprise Investment Scheme) |

|---|---|---|

| Target Companies | Early-stage but established SMEs | Very early-stage startups |

| Max Investment per Tax Year | £1 million (up to £2 million for knowledge-intensive companies) | £100,000 |

| Income Tax Relief | 30% | 50% |

| Capital Gains Tax (CGT) Deferral | Yes | No |

| CGT Exemption | Yes (after 3 years) | Yes (after 3 years) |

| Loss Relief | Yes (against income or capital gains) | Yes (against income or capital gains) |

| Minimum Holding Period | 3 years | 3 years |

| Business Age Limit | Less than 7 years since first commercial sale | Less than 2 years since incorporation |

| Maximum Company Asset Value | £15 million before investment | £200,000 before investment |

| Maximum Company Employees | 250 | 25 |

| Risk Level | Moderate to high | High |

These schemes can be accessed via dedicated platforms like GCV Invest, SyndicateRoom, and Seedrs, many of which offer hand-picked opportunities vetted for growth potential and tax efficiency. While EIS and SEIS shares are illiquid and typically held for 3–7 years, the risk is often justified by the strong upside and valuable tax reliefs.

For those willing to invest in innovation while managing risk through structured incentives, EIS and SEIS remain among the most effective venture-stage opportunities available in the UK.

6. High-Yield Corporate Bonds

Corporate bonds with sub-investment-grade ratings — often referred to as junk bonds — offer interest yields far above traditional bonds, sometimes exceeding 8–10%. These returns come at the cost of higher credit risk, but diversified bond funds can help reduce exposure to individual issuer default.

High-yield bonds are particularly sensitive to market cycles. In a strong economy, they often thrive. But in periods of recession or high default rates, capital loss is a serious concern. Investors should examine bond maturity dates, issuer balance sheets, and overall economic forecasts before committing funds.

7. Peer-to-Peer Lending

Peer-to-peer (P2P) lending offers a modern alternative to banking systems, allowing investors to lend directly to individuals or businesses via online platforms. Returns have historically ranged between 6–8% annually, and although defaults can happen, diversified lending portfolios help spread risk.

Many UK platforms now offer Innovative Finance ISAs (IFISAs), allowing investors to earn interest tax-free. The sector has matured significantly, with better risk assessment tools, improved borrower screening, and regulatory oversight by the FCA.

8. Property Bonds

Property bonds offer fixed returns by investing in development projects or real estate-backed lending. These bonds are typically short to medium-term in duration and provide yields between 4% and 8%, with some higher-return offerings available over longer terms.

While less volatile than equities, property bonds are not risk-free. Investors must understand the underlying project, developer experience, and repayment structure. Bonds held within an IFISA structure add tax efficiency and further appeal.

What Lower-Risk Investments Can Still Generate Meaningful Growth?

9. Lower-Risk Single Stocks

Investing in well-established companies with consistent earnings and long-term viability often referred to as blue-chip stocks, can deliver respectable returns of 5% to 10% annually. These stocks are generally more stable and less prone to dramatic swings, making them suitable for conservative investors who still want some exposure to equity markets.

Examples in the UK might include companies like Tesco, National Grid, or GlaxoSmithKline, all of which have strong balance sheets and resilient business models. These types of investments offer the dual benefit of capital growth and income from dividends.

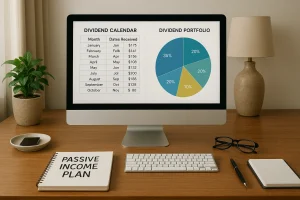

10. Dividends from Established Companies

Dividend investing remains one of the most effective passive income strategies, particularly for those approaching retirement or seeking stable returns. Established firms with a track record of regular payouts can yield anywhere from 3% to 8% per year, depending on sector and market performance.

However, investors should avoid focusing solely on dividend yield. Extremely high dividend rates may indicate financial instability. Instead, look for sustainable payout ratios and consistent earnings. For those wishing to reduce risk further, dividend ETFs can offer diversified exposure across multiple dividend-paying companies.

11. Rental Properties

The UK’s property market remains a cornerstone of wealth-building strategies, particularly in areas with strong rental demand. Buy-to-let properties can offer combined returns from rental income and capital appreciation, with gross yields typically ranging from 5% to 8% depending on location.

However, recent changes in tax treatment, energy efficiency regulations, and mortgage interest rules have made direct property investment more complex. Investors should be mindful of:

- Ongoing maintenance costs

- Vacancy risk

- Illiquidity of property assets

For those who want real estate exposure without the operational burden, real estate investment trusts (REITs) and property funds are alternatives worth exploring.

12. Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) have grown into one of the most accessible and widely used investment tools for UK investors. Offering low-cost exposure to a broad range of markets, sectors, and themes, ETFs are ideal for both beginners and experienced investors seeking diversification and long-term capital growth.

Unlike mutual funds, ETFs are traded on stock exchanges, which means they can be bought and sold like regular shares. This makes them more flexible, with pricing that reflects real-time market movements. Most ETFs are passively managed, meaning they simply replicate the performance of an index like the FTSE 100, S&P 500, or MSCI World.

Over the past century, broad-market ETFs like those tracking the S&P 500 have delivered average annual returns close to 10%, outperforming many actively managed funds with significantly lower costs.

UK investors also benefit from the ability to hold ETFs within Stocks and Shares ISAs or Self-Invested Personal Pensions (SIPPs), allowing for tax-efficient growth and income.

Table: Popular ETF Categories and Their Characteristics

| ETF Category | Example ETFs | Exposure Type | Average Annual Return (Historic) | Typical Fees (TER) | Risk Level |

|---|---|---|---|---|---|

| UK Market | iShares Core FTSE 100 ETF | Large UK Companies | 5–7% | 0.07–0.20% | Moderate |

| US Market | Vanguard S&P 500 ETF | Top 500 US Companies | ~10% | 0.03–0.07% | Moderate-High |

| Global Diversified | Vanguard FTSE All-World ETF | 3,000+ Companies Worldwide | 8–9% | 0.22% | Moderate |

| Sector-specific | iShares Global Clean Energy ETF | Renewable Energy Firms | Variable (High Volatility) | 0.42–0.65% | High |

| Dividend Focused | SPDR S&P Global Dividend Aristocrats ETF | High Dividend-Paying Stocks | 3–6% (plus income) | 0.35% |

Why Choose ETFs in 2026?

- Cost-efficient: Most ETFs have very low management fees.

- Diversification: One ETF can hold hundreds or thousands of companies.

- Liquidity: Tradeable during market hours, just like individual stocks.

- Tax-efficiency: Suitable for ISA and SIPP wrappers.

In 2026, ETFs remain one of the most effective long-term tools for investors seeking stability, exposure to global growth, and passive income through dividend-paying funds.

13. Bonds (Government and Investment-Grade)

Bonds especially UK gilts and investment-grade corporate bonds, are trusted tools for capital preservation and predictable income. Although not typically considered “high-return” assets, they offer a stabilising effect within diversified portfolios, particularly during market downturns or recessions.

As of 2026, yields on 10-year UK gilts have reached nearly 5%, their highest since the 2008 financial crisis. This makes them competitive with some equity-based income strategies, especially when factoring in their low risk profile.

Investment-grade corporate bonds, issued by financially strong companies, offer slightly higher yields than government bonds but still maintain a relatively low default risk. These instruments provide a steady stream of income and are ideal for cautious investors or those nearing retirement.

Table: Bond Comparison (2026 Outlook)

| Bond Type | Typical Yield (2026) | Risk Level | Liquidity | Suitable For | Tax Consideration |

|---|---|---|---|---|---|

| UK Government Bonds (Gilts) | 4.5%–5.0% | Very Low | High | Capital preservation, low-risk income | Interest taxable outside ISA |

| Investment-Grade Corporate Bonds | 5.0%–6.0% | Low-Moderate | Medium to High | Income-focused investors | Taxable unless held in ISA/SIPP |

| Bond ETFs | 3.5%–5.5% | Varies by mix | High | Diversified fixed-income exposure | Eligible for tax wrappers |

Why Bonds Still Matter:

- Income Stability: Regular fixed interest payments.

- Capital Security: Especially true with gilts and AAA-rated bonds.

- Diversification: Offsets equity market volatility.

- Flexibility: Available through direct purchase or bond-focused ETFs and funds.

In times of economic uncertainty or market corrections, bonds become a defensive anchor in any balanced investment portfolio. While their returns may not match equities or alternative assets, they serve a critical role in managing overall risk.

Where Should You Invest in 2026 Based on Economic Scenarios?

The ideal investment in 2026 will depend on the broader economic climate. Here’s how various asset classes align with likely scenarios:

| Scenario | Most Suitable Investments | Avoid These Assets |

|---|---|---|

| Growth | Equities, ETFs, Angel Investing, Private Equity | Government Bonds, Cash |

| Recession | Bonds, Dividend Stocks, P2P Lending, Rental Properties | High-Risk Stocks, Crypto |

| Stagflation | Income Real Estate, Gold, Infrastructure ETFs, Property Bonds | Long-Term Bonds, Speculative Tech Stocks |

What Should Investors in the UK Focus On in 2026?

With global uncertainty at the forefront, UK investors must prioritise:

- Diversification across sectors and asset types

- Tax efficiency through ISAs, pensions, and EIS/SEIS schemes

- Monitoring macro trends: inflation, interest rates, and geopolitical risk

- Adjusting strategies based on personal risk tolerance and time horizon

Whether you’re starting small or managing a larger portfolio, understanding how to invest money and make money in 2026 requires balancing caution with calculated risk. From traditional assets to modern innovations, the best path forward is often a carefully constructed combination of both.

Overview of 13 Investment Options in 2026

| Investment Type | Risk Level | Potential Return (Annual Avg.) | Liquidity | Time Horizon | Tax Efficiency (UK) | Suitable For |

|---|---|---|---|---|---|---|

| 1. Cryptocurrency | Very High | Variable (10%–1000%+) | High | Short to Medium | Limited (subject to CGT) | High-risk seekers, tech-savvy investors |

| 2. Angel Investing (No Relief) | Very High | 20%+ (2–3x over 3–5 yrs) | Very Low | Long Term (5–7 yrs) | None | Active investors, startup enthusiasts |

| 3. High-Risk Single Stocks | High | 10%+ | High | Short to Long | CGT applies, ISAs available | Aggressive investors with market expertise |

| 4. Private Equity | High | ~13% (average) | Low | Long Term (5+ yrs) | Some tax advantages via SIPP structures | Experienced, long-term investors |

| 5. EIS & SEIS Investments | High (reduced by reliefs) | 10x+ potential | Very Low | Long Term (3–7 yrs) | Very High (Income Tax, CGT deferral, loss relief) | Tax-conscious, high-net-worth individuals |

| 6. High-Yield Corporate Bonds | Moderate to High | 5%–10% | Medium | Medium Term | Taxable unless in ISA/SIPP | Yield-focused, balanced-risk investors |

| 7. Peer-to-Peer Lending | Moderate | 6%–8% | Medium | 1–5 Years | Tax-free in IFISA | Income seekers, alternative lenders |

| 8. Property Bonds | Moderate | 4%–10% | Low to Medium | 2–5 Years | Often IFISA-eligible | Passive real estate investors |

| 9. Lower-Risk Single Stocks | Moderate | 5%–10% | High | Medium to Long | CGT applies, ISAs available | Conservative equity investors |

| 10. Dividend Stocks | Moderate | 3%–8% + growth | High | Medium to Long | ISAs can shelter dividend tax | Passive income seekers, retirees |

| 11. Rental Properties | Moderate | 5%–8% + appreciation | Low | Long Term (5–10 yrs) | Taxed on rental income, CGT on sale | Long-term, hands-on investors |

| 12. ETFs | Low to Moderate | 5%–10% (Index-based) | High | Medium to Long | Highly tax-efficient in ISA/SIPP | Beginners, passive investors, long-term savers |

| 13. Government/Grade Bonds | Low | 2%–5% | High | Short to Medium | Taxable unless in ISA/SIPP |

Frequently Asked Questions

What is the safest investment in the UK in 2026?

UK government bonds (gilts) and investment-grade corporate bonds are among the safest, offering steady returns with low risk.

Can I start investing with just £100 in 2026?

Yes, many platforms like Freetrade, Moneybox, and Plum allow UK investors to start with as little as £1–£100.

Are ETFs a good investment in 2026?

Yes, ETFs offer low-cost, diversified exposure to markets and are ideal for long-term investing, especially within ISAs or SIPPs.

Is property still a reliable way to make money?

Yes, but rental yields vary by location, and regulatory and tax changes make it more suitable for long-term, hands-on investors.

What returns can I expect from dividend stocks?

Typically 3%–8% annually, plus potential capital growth if the company performs well.

Is cryptocurrency still worth investing in?

For high-risk investors, yes. But crypto remains volatile, so limit exposure and invest only what you can afford to lose.

How do EIS and SEIS help reduce investment risk?

They offer generous tax reliefs, including income tax reduction, CGT deferral, and loss relief—helping offset risks in early-stage investing.