Universal Credit Cost of Living Payment: When Will It Be Paid?

The Cost of Living Payment is a financial support initiative introduced by the UK Government to assist those on low incomes or means-tested benefits during periods of economic hardship.

With energy prices, inflation, and basic living expenses rising, many households have relied on this payment to manage essential costs.

Understanding the payment dates, eligibility, and how to address missed payments is crucial for anyone receiving Universal Credit or other qualifying benefits in the UK.

What is the Cost of Living Payment and Who Is Eligible?

The Cost of Living Payment was introduced by the UK Government to help low-income households manage rising living expenses during the cost of living crisis. This support was aimed at individuals receiving means-tested benefits and was structured across several instalments between 2022 and 2024.

These payments are made automatically to those who qualify. There is no separate application process, and eligibility is determined based on whether the claimant received a qualifying benefit during specific assessment periods. The Department for Work and Pensions (DWP) uses an automated system to identify eligible claimants.

Which Benefits Qualify for the Cost of Living Payment?

To qualify, claimants must have received at least one of the following benefits during the relevant qualifying dates:

- Universal Credit

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Income Support

- Pension Credit

- Child Tax Credit

- Working Tax Credit

Those receiving only New Style JSA, New Style ESA or contributory ESA were excluded. Additionally, people receiving both tax credits and a DWP-administered benefit typically received the payment from DWP only.

Are There Any Income-based Thresholds or Exceptions?

For tax credit recipients, the total annual entitlement must exceed £26. Universal Credit recipients are excluded from the payment if they had a nil award during the assessment period unless that zero amount resulted from deductions such as rent arrears or hardship payments.

When Will the Universal Credit Cost of Living Payments Be Made?

Universal Credit recipients receive the Cost of Living Payment based on the end date of their benefit assessment period. If the assessment period aligns with the qualifying window, they are automatically eligible for the respective payment.

Below is a table showing the payment dates related to Universal Credit:

| Payment Amount | Assessment Period End Date | Payment Window |

|---|---|---|

| £299 | 13 November – 12 December 2023 | 6 February – 22 February 2024 |

| £300 | 18 August – 17 September 2023 | 31 October – 19 November 2023 |

| £301 | 26 January – 25 February 2023 | 25 April – 17 May 2023 |

| £324 | 26 August – 25 September 2022 | 8 November – 23 November 2022 |

| £326 | 26 April – 25 May 2022 | 14 July – 31 July 2022 |

Claimants may experience a delay in receiving the payment if there are administrative changes such as updating the bank account where benefits are paid or if eligibility is confirmed retrospectively.

What Are the Payment Dates for Other Eligible Benefits?

Other low-income benefits also qualify for the Cost of Living Payment. The eligibility for these payments depends on the recipient receiving a qualifying benefit for at least one day during a set window.

Income-based JSA, ESA, Income Support and Pension Credit

If a claimant received any of these benefits during the qualifying window, they became eligible for the corresponding payment. Below is a table summarising the payment dates for these benefits:

| Payment Amount | Eligibility Period | Payment Window |

|---|---|---|

| £299 | 13 November – 12 December 2023 | 6 February – 22 February 2024 |

| £300 | 18 August – 17 September 2023 | 31 October – 19 November 2023 |

| £301 | 26 January – 25 February 2023 | 25 April – 17 May 2023 |

| £324 | 26 August – 25 September 2022 | 8 November – 23 November 2022 |

| £326 | 26 April – 25 May 2022 | 14 July – 31 July 2022 |

If a claimant was entitled to these benefits but did not receive a payment due to a low entitlement value (such as 1p to 9p), they may still be eligible for the Cost of Living Payment.

Tax Credit Payment Schedules

Individuals who received only Child Tax Credit or Working Tax Credit were paid by HMRC rather than DWP. The payment dates vary slightly but follow the same eligibility principle.

Key details to note:

- If both Child and Working Tax Credits were being paid, only the Child Tax Credit qualified for the payment.

- If both HMRC and DWP-administered benefits were being received, only one Cost of Living Payment was made, typically by DWP.

| Payment Amount | Eligibility Period | Payment Window |

|---|---|---|

| £299 | 13 November – 12 December 2023 | 16 February – 22 February 2024 |

| £300 | 18 August – 17 September 2023 | 10 November – 19 November 2023 |

| £301 | 26 January – 25 February 2023 | 2 May – 9 May 2023 |

| £324 | 26 August – 25 September 2022 | 23 November – 30 November 2022 |

| £326 | 26 April – 25 May 2022 | 2 September – 7 September 2022 |

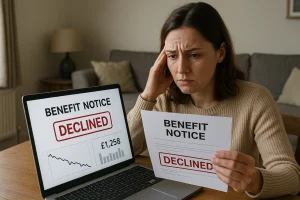

What Happens If You Haven’t Received Your Payment?

If a Cost of Living Payment is not visible in a bank or credit union account, claimants should contact the benefit office responsible for their payments. It is advised to wait until the end of the payment window before making any enquiries.

Some reasons a payment might be delayed include:

- Recent changes to the account where the benefit is paid

- A delay in backdated benefit approval

- Internal system checks within DWP or HMRC

Claimants should be cautious of scams. The DWP and HMRC do not request application forms or ask for personal bank details to make these payments. All legitimate payments are made automatically.

Can You Appeal a Decision or Report a Missing Payment?

The Department for Work and Pensions uses an entirely automated system to determine who is eligible.

This automation limits the risk of manual errors and speeds up payment distribution. However, if a claimant disagrees with a decision or believes they were wrongly excluded, they have the right to request further explanation.

The process includes:

- Contacting the benefit office and asking for an explanation

- Supplying new information if something has changed

- Requesting a reconsideration if something was overlooked

Claimants can also contact DWP in writing or by phone to appeal or raise concerns about eligibility.

What Are the Common Reasons for Ineligibility?

Universal Credit ‘Nil Awards’ Explained

One of the most common reasons Universal Credit recipients miss out on the Cost of Living Payment is having a nil award for the relevant assessment period. This happens when a person’s income, savings, or other circumstances result in no Universal Credit payment being made.

Common causes of nil awards include:

- More than one salary payment within the assessment period

- Increased earnings or savings

- Receiving another benefit that offsets entitlement

- Sanctions due to non-compliance with job-seeking commitments

Despite a nil award, if the only deductions were for rent arrears or hardship, the claimant may still qualify.

Tax Credit Ineligibility Criteria

Those receiving tax credits are ineligible if their annual entitlement is below £26. This rule automatically disqualifies individuals who fall below the income threshold required to trigger payment eligibility.

Is There a Cost of Living Payment Planned for 2025?

As of November 2025, there is no formal announcement regarding a continuation of the Cost of Living Payments into 2025. The UK Government has not published any updated schedules, eligibility criteria or payment timelines for the coming year.

However, it is possible that further support measures could be announced depending on inflation trends, household energy costs and other economic factors.

The Government typically uses the Autumn Statement or the Spring Budget to confirm upcoming financial assistance. Until then, claimants are advised to monitor the official GOV.UK website for verified updates.

What Other Support is Available to Help with Living Costs?

In the absence of further Cost of Living Payments, several forms of local and national support remain accessible to those struggling with essential costs.

Some of the available options include:

- Household Support Fund through local councils in England

- Discretionary Assistance Fund in Wales

- Crisis Grants and Community Care Grants in Scotland

- Discretionary Support or Short-Term Benefit Advance in Northern Ireland

These funds can help with one-off expenses such as emergency heating costs, food, or essential household needs. In many cases, local councils have discretion over the type and amount of support they provide.

Using Benefits Calculators for Additional Help

Individuals unsure of their entitlements can use online benefits calculators to identify support. These tools consider income, household size and location to suggest benefits that may be available.

Popular calculators include:

- Entitledto

- Turn2us

- Policy in Practice

They are free to use and provide anonymous assessments, giving individuals a clearer picture of potential help without needing to contact benefit offices directly.

How Does the Government Determine Eligibility and Payments?

The eligibility process for Cost of Living Payments is handled entirely through automated systems managed by DWP and HMRC. No manual application is required. The system cross-references payment history and assessment periods to determine eligibility.

Key points about the process:

- Payments are non-taxable and do not affect other benefits

- Claimants are paid using the same method as their main benefit

- Joint claims receive a single payment per household

- If a person is later deemed ineligible, the payment may be reclaimed

This system ensures that payments are distributed efficiently, though it also means claimants must be proactive in ensuring their details are correct with benefit offices to avoid delays.

Conclusion

The Cost of Living Payment has provided vital relief to millions of UK households receiving Universal Credit and other benefits. Knowing the eligibility criteria, payment windows, and how to resolve issues like missing payments ensures that those entitled receive the support they need.

Although no payments have been confirmed for 2025, monitoring updates from GOV.UK and exploring other available financial support options can help households stay prepared for any future government assistance initiatives.

FAQs About Cost of Living Payments

How can I check if I was eligible for a payment?

You can check eligibility by reviewing your benefit award letter or contacting the office responsible for your payment. You must have met the conditions during specific qualifying periods.

What should I do if I received a scam message about cost of living payments?

Do not click on any links. Official payments are made automatically, and no one will contact you asking for bank details. Report scams to Action Fraud or the official GOV.UK site.

Can I get a payment if my benefit was backdated?

Yes, if your benefit was backdated and covers the qualifying period, you should receive the payment automatically.

Is the cost of living payment taxable?

No, the payment is not subject to income tax and will not affect your other benefit entitlements.

Will there be another energy support payment in 2025?

As of now, there’s no confirmed support scheme for energy bills in 2025, though it may be revisited in future fiscal announcements.

Can I get both the Disability and Universal Credit Cost of Living Payments?

Yes, if eligible for both, you may receive each of the separate payments, but not duplicates from DWP and HMRC.

What happens if I change my bank account or benefit provider?

Your payment might be delayed but will still be made automatically once records are updated.